Yes, you get taxed when you exercise startup stock

Employee stock options tax

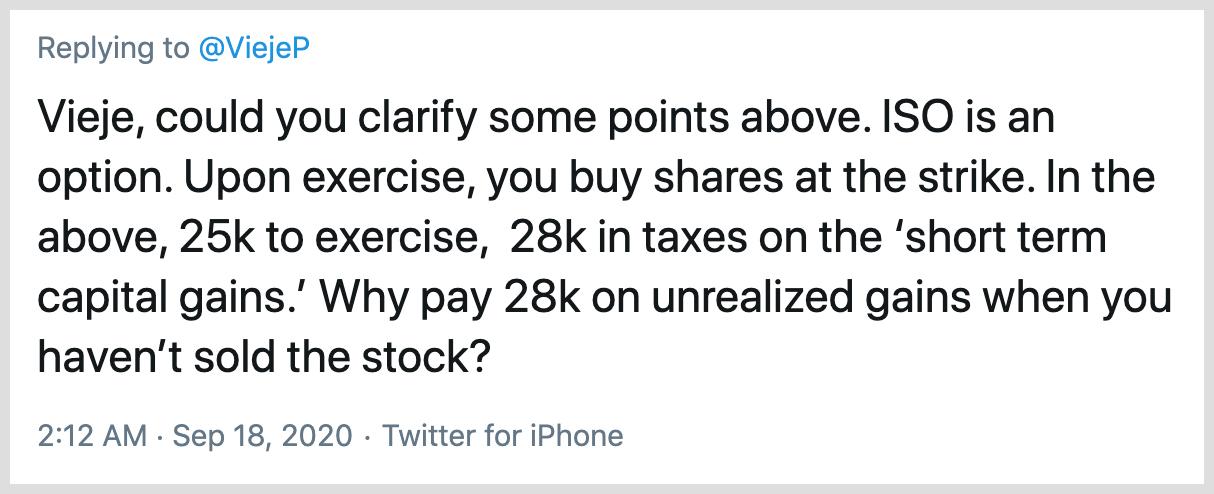

Our Snowflake case study sparked quite the debate on Twitter.

One common response was: wait – you're telling me I owe tax when I exercise my stock options?

Some were confused, others were quite sure I was making an error. Goes to show just how unintuitive this all is.

The answer: yes — in almost all cases.

This is still unknown to most startup employees. And it's probably the number one topic I discuss with clients.

Here are the highlights:

- If the current 409A valuation (also known as fair market value) of your company’s shares is higher than your strike price, you’re going to owe taxes when you exercise

- The bigger the difference, the more you’ll owe

- There are a two exceptions to this rule (but they don’t apply to most people)

Note: If exercising your options creates a tax bill you can’t afford, Secfi can help cover the costs. Learn more here.

Tax on stock options

Exercise tax bills can become pretty extreme. Then can get as much as 10x higher than the strike price you pay to actually buy the shares.

Some examples of people I know:

Engineer at Doordash:

- $15k strike price

- $110k in taxes

Strategy Analyst at Snowflake:

- $100k strike price

- $125k in taxes

Secfi's own Wouter Witvoet at his previous company:

- $50k strike price

- $1.8m in taxes (yes, million 🥵)

Taxes can get so high that exercising becomes virtually impossible for many people. Theoretically, there's no limit to how high they can get.

Which brings up the question:

Why do I have to pay taxes when I'm not making any money

It’s weird, right? But it's the way our tax system is built.

Let’s get into the details...

So how are stock options taxed when exercised?

When you exercise stock options, you're buying shares.

The government considers these shares to have value. That value is based on whatever the 409A valuation (or fair market value) is on the day you exercise.

If the 409A is higher than your strike price, you're making an "assumed gain" in the eyes of the IRS.

That (phantom) gain is what you're taxed on 👻

Here's an example:

How the 409A affects the amount you'll owe

Say you have 1,000 options at a strike price of $2.50, and the current 409A valuation is $10.

When you exercise you’ll pay:

- The strike price of $2,500 (= 1,000 * $2.50)

- Taxes on your phantom gain of $7.50 (= $10 - $2.50) for every exercised option

How much you're taxed depends on whether you have NSOs or ISOs:

- For NSOs you’ll pay the ordinary income tax rate

- For ISOs you’ll pay a tax called the alternative minimum tax (or AMT)

There's no limit to the 409A valuation of a company, just like any stock price. The more successful your company becomes, the higher the 409A valuation gets.

And that's why your tax bill can grow endlessly.

Wait, aren’t ISOs supposed to be tax-free?

Yes, they're supposed to.

The "exception" to this is when you trigger the AMT. But in practice this almost always happens.

So it's not really an exception. And since most people don't know about the AMT, it's a major source of confusion.

How to quickly figure out your tax liability when you exercise your options

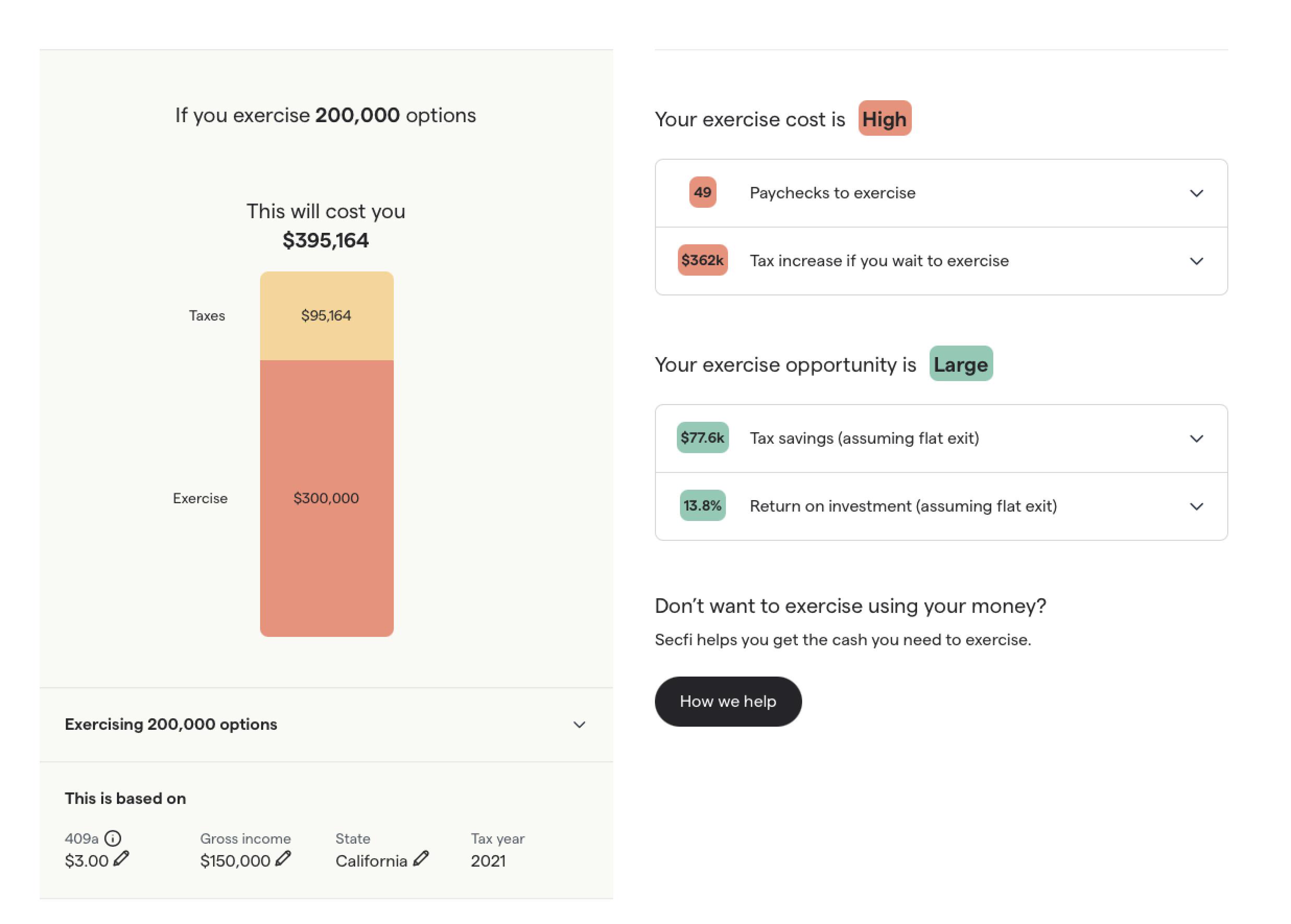

Before exercising, you'll want to know the tax bill you're about to trigger. But by hand that calculation gets messy. The AMT is complicated, and it depends on your income, tax brackets, etc.

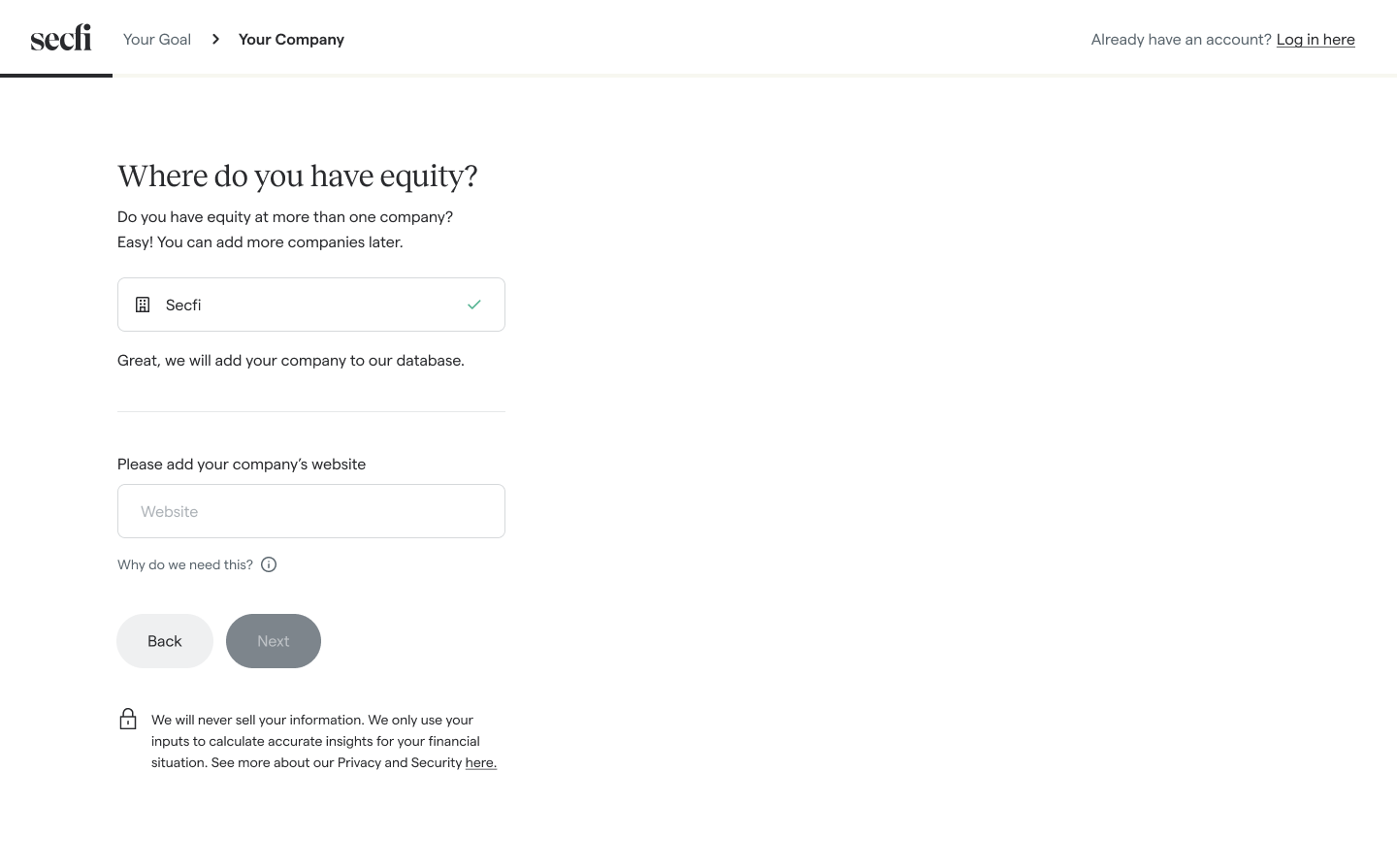

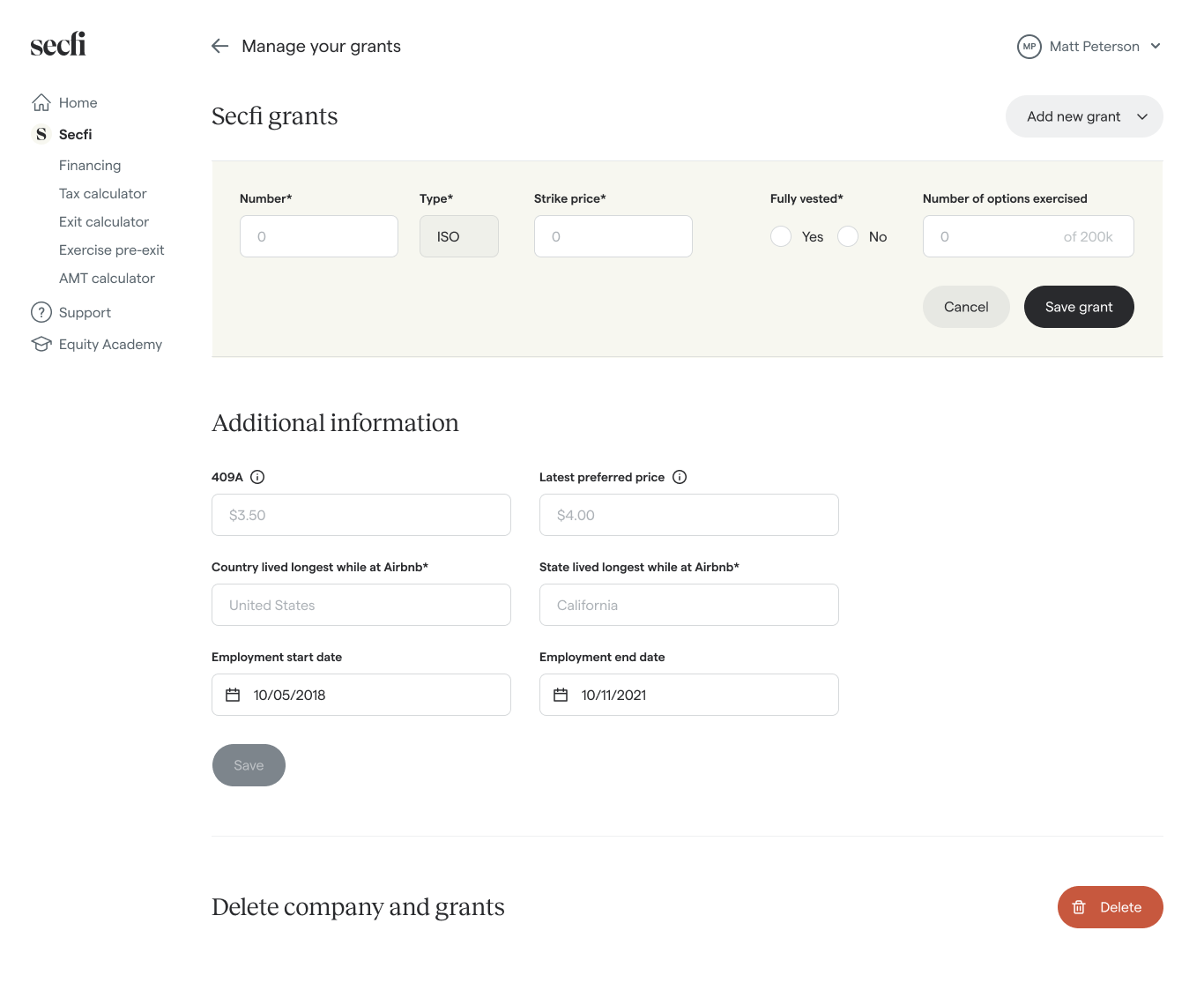

To make it as easy as possible, we've built an online calculator that crunches the numbers for you (and it's free).

1. Sign up

2. Add your stock options

3. Open the Stock Option Tax Calculator

There you go.

If you feel like geeking out fiscally (no judgements here—I'm just like you 🤓) you'll also be able to see the full tax breakdown and explore how to minimize taxes.

To use the calculator, sign up here.

The exceptions: when do you not owe tax when exercising?

As the title of this post says: you're going to have to pay taxes... probably.

There are two exceptions to the rule:

1. When the 409A valuation is equal to (or lower than) the strike price of your stock options

When that happens, you're not making a "phantom gain." So there's nothing to be taxed on.

(This applies to both ISOs and NSOs.)

2. When you exercise just a small amount of ISOs

This way your "phantom gain" is low enough to not trigger the AMT. (But this only applies to ISOs.)

Two strategies to avoid a tax bill when exercising

In some cases, you can use the above exceptions to your advantage and avoid having to pay taxes.

Here's how:

1. Early exercising (ISOs and NSOs)

Some companies allow you to early exercise your options.

This means you can exercise your stock options before they fully vest.

Because the strike price of your stock options is usually set to the 409A valuation at the time you're granted the options, early exercising lets you exercise before the 409A valuation goes up. That way you're not making a phantom gain—and you won't owe any taxes.

⚠️ Warning: If you early exercise, make sure to file an 83(b) election. Otherwise you might end up with an unexpected tax bill down the road.

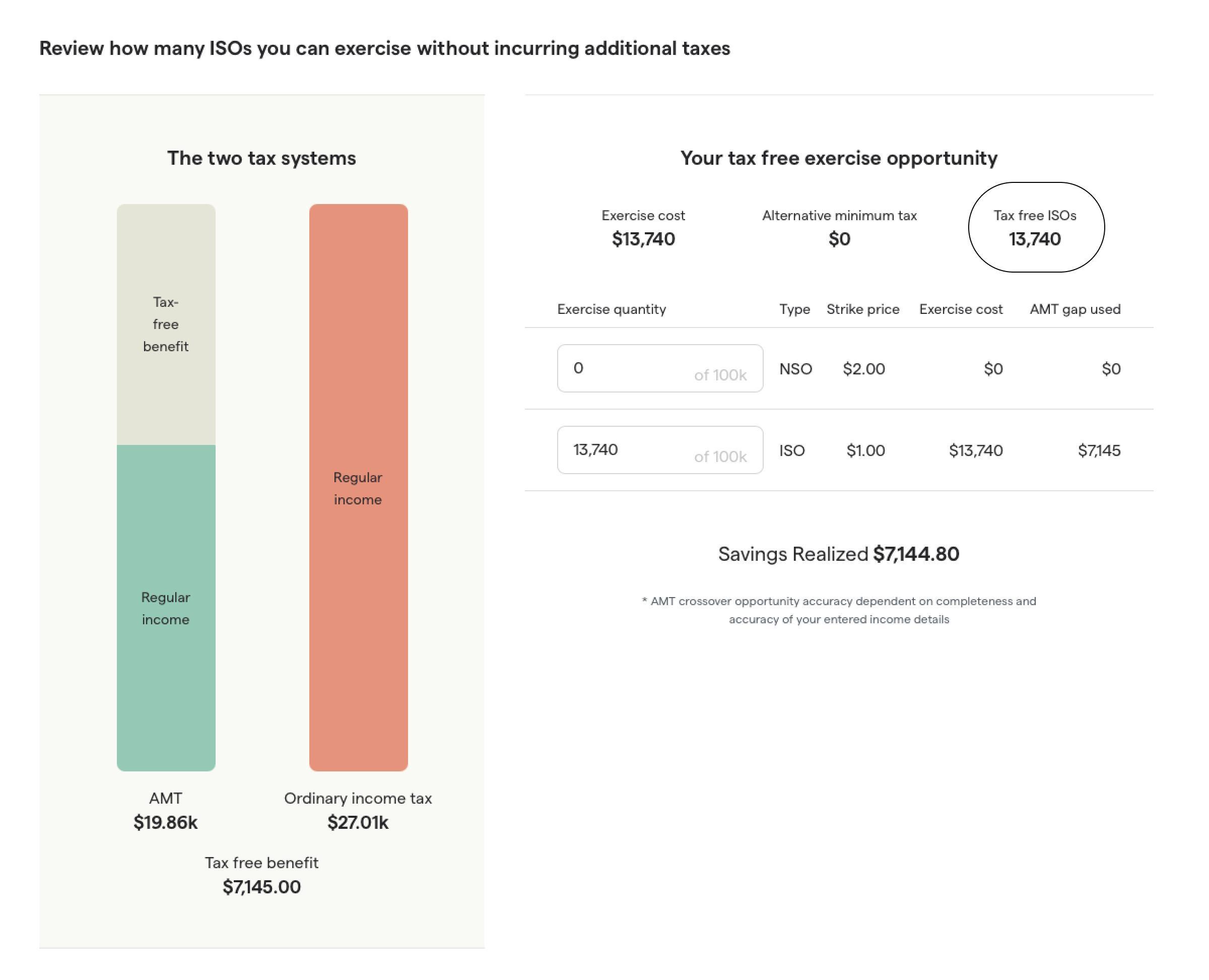

2. Staying below the AMT threshold (ISOs only)

If you exercise your ISOs, you'll pay alternative minimum tax (AMT)—but only if you go above a certain threshold.

This means that, every year, you can exercise a number of ISOs tax-free.

The maximum number of tax-free ISOs depends on your tax situation (but it comes with its own downsides).

We built a free calculator that runs the numbers for you:

Create an account here to use the calculator.

Let's fix this misconception for once and for all 💪

Out of the hundreds of startup employees I've advised, more than two-thirds didn't know that exercising stock options also means writing a (big) check to the government.

And it's not surprising that this isn't well-known:

- Employers don't always explain our complicated tax system when granting stock options

- It's counter-intuitive. Why pay tax when not making actual gains?

- It's a stubborn startup myth that exercising ISOs is tax-free

But it is a problem. Especially when employees discover the size of their tax liability after exercising and there’s no way back. (This really happens.)

I posted this explanation to try and clear the confusion for good. Hope it helps spread the word 🤞.

And if you have impossibly high exercise costs yourself, be sure to check out Secfi financing as a means of covering the cost.