The new startup benefit: Equity education

Equity Education Survey

Equity, in the form of stock options, is a key component of startup compensation. Yet, companies aren't going the extra mile to help their team understand and maximize their equity potential. Startup employees are demanding more education and citing its importance when joining, engaging, and staying with their company.

Secfi surveyed more than 1,000 startup employees who exercised their stock options to understand their personal motivators and the role their company played in their decision-making process.

Key findings:

- 75% of startup employees say stock options were an important reason they joined their company and 92% have taken a personal financial risk to own their options.

- Startup employees say they value being educated about stock options (87%) more than the options themselves (78%).

- 57% of companies are not doing enough to educate employees about their equity.

Equity is a significant compensation benefit for employees.

75% say that stock options were an important reason they joined their company

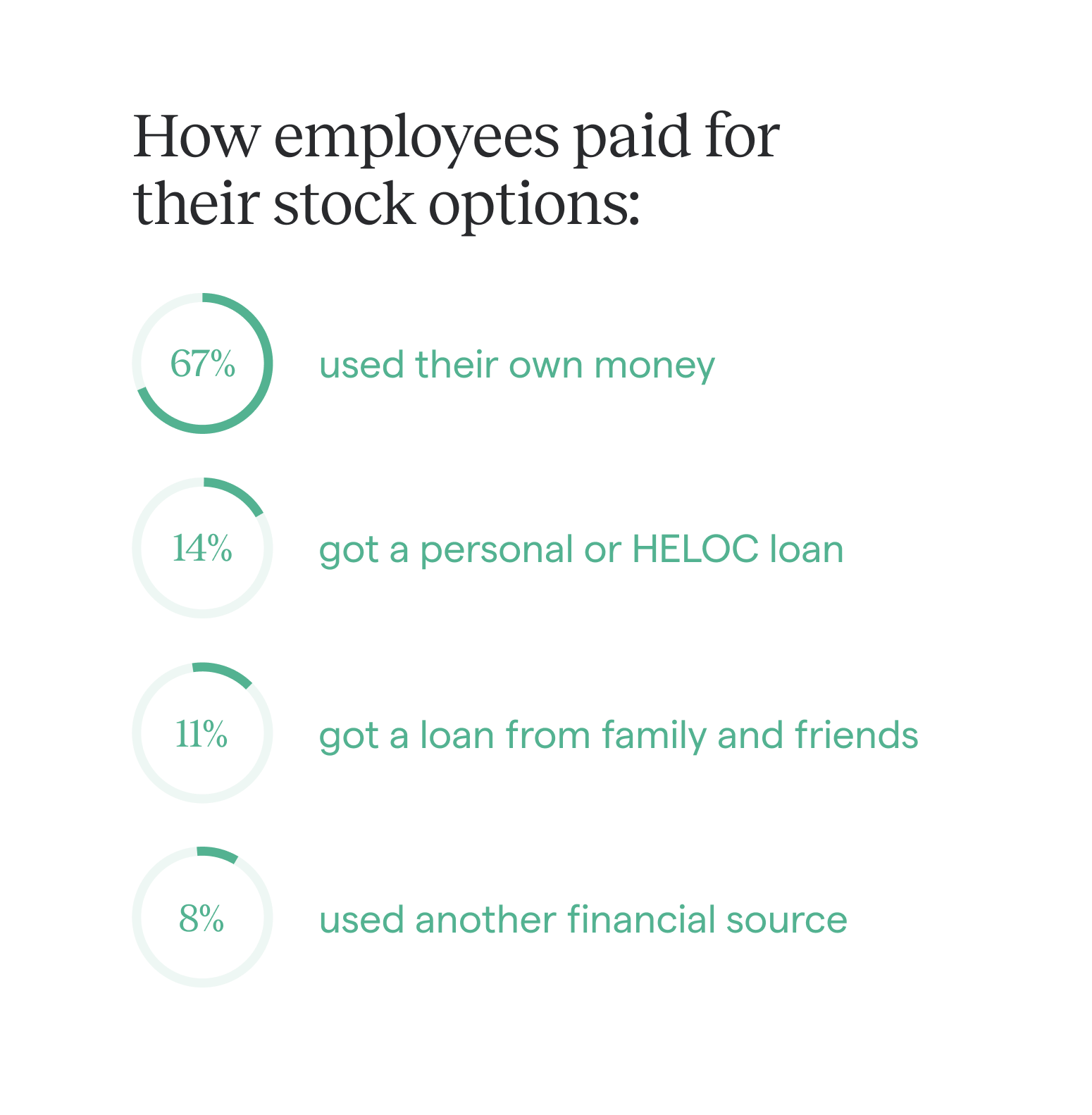

92% took on personal financial risk in order to own their options.

Buying stock options can be risky because there’s no guarantee that the company will go public or get acquired. Those who use their own cash savings or take out loans to cover exercise costs have no way of recouping the costs if their company has a less-than-favorable exit.

88% say it's very important for companies to offer equity education

Startup employees want their company to help them understand stock options. Employees expect their company to provide equity education to make an informed decision about their stock options.

Startup employees state equity education is a key motivator for joining and being engaged with their company.

The startup community values the educational resources their company provides to help them make an important financial decision.

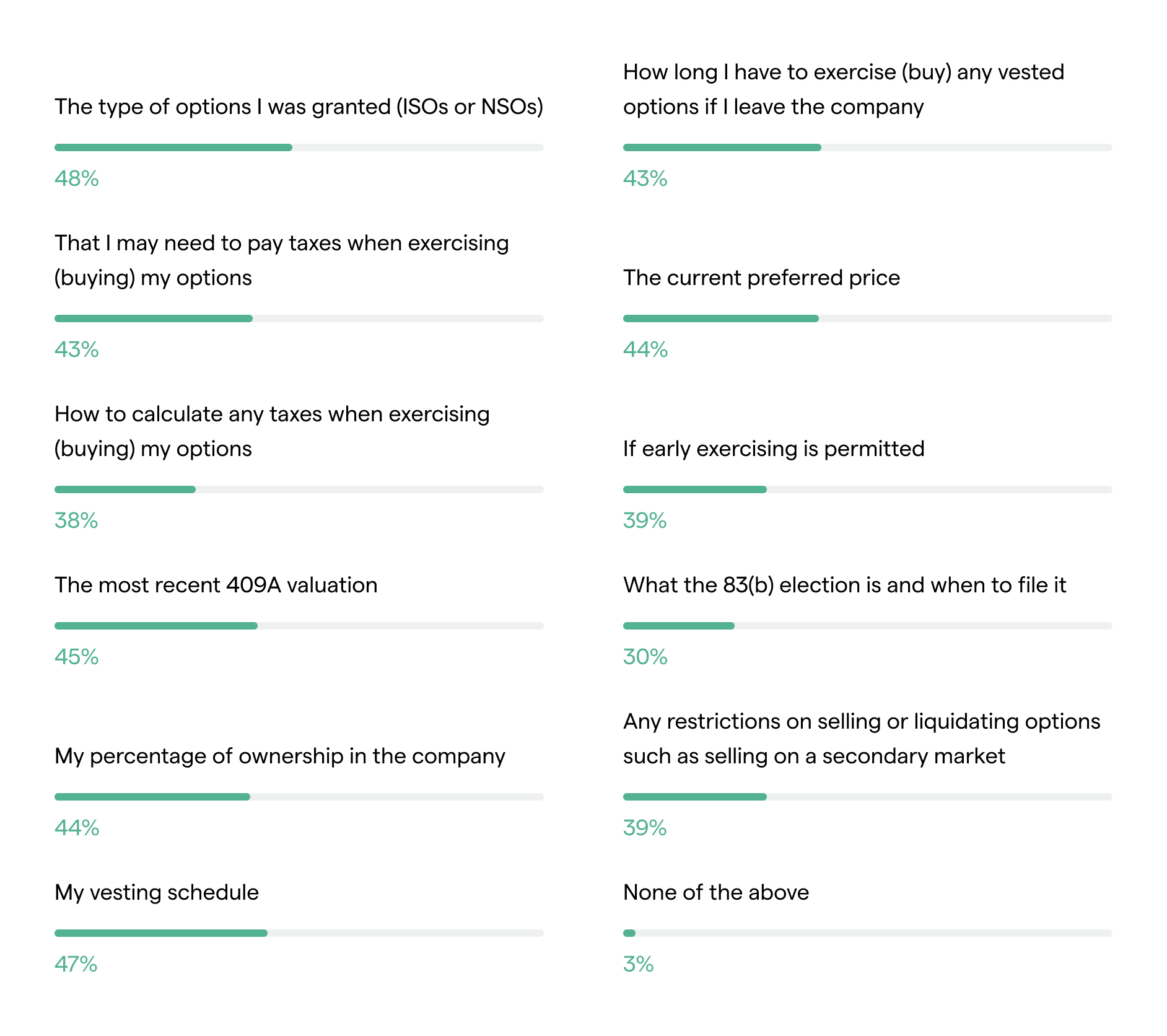

Employees are not given key equity details when hired.

“When I was hired, I was provided the following details about my stock options:”

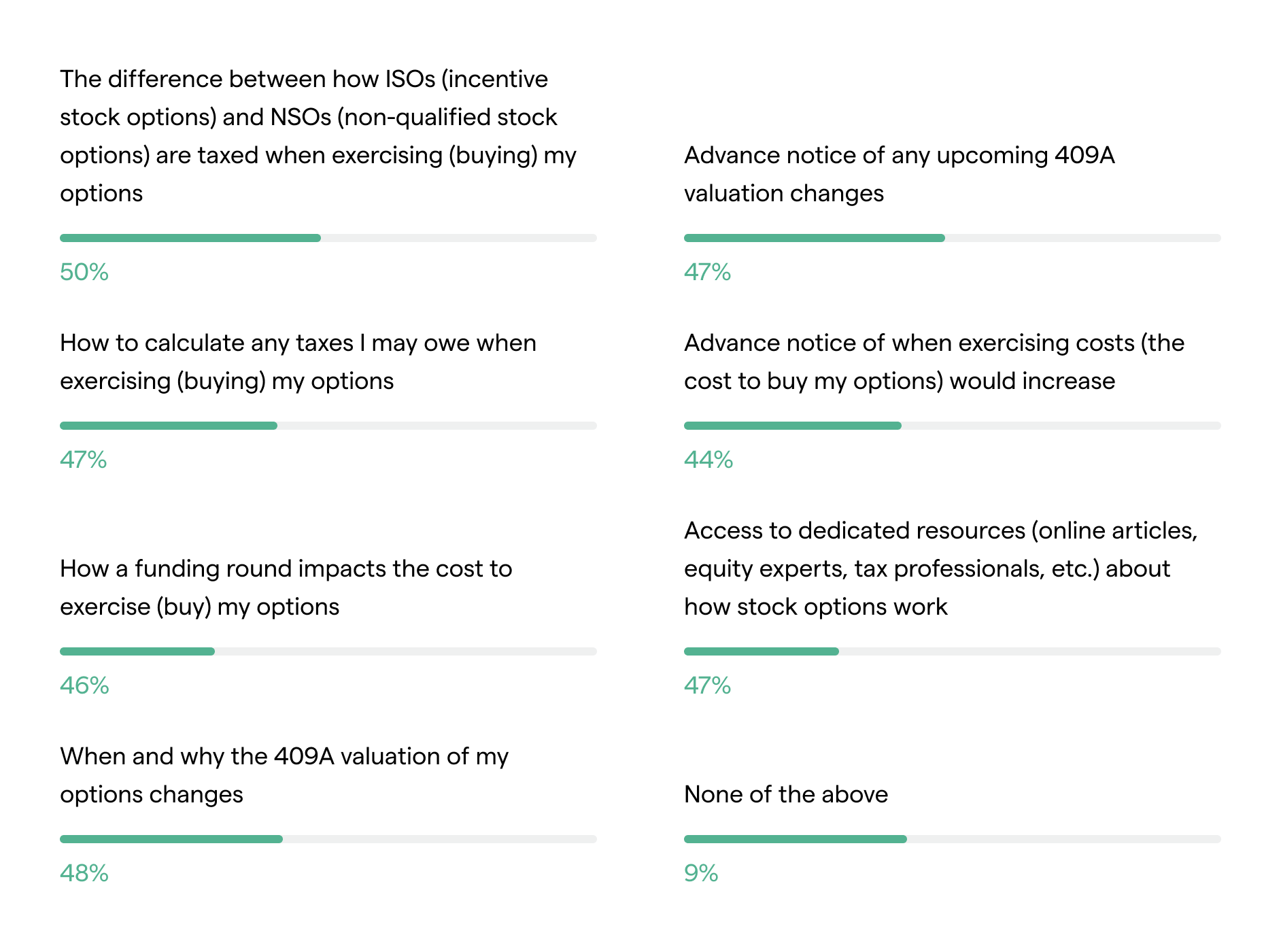

Employers are also not letting employees know how company events impact their equity.

"My company provided me with the following information about my options proactively:"

Companies can use equity education as a benefit to attract and retain talent.

Other studies, including a report by McKinsey & Company, also show that employees care more about feeling valued by their companies than they do about compensation, especially in the era of "The Great Resignation."

Leading startups are taking these 4 steps to help employees

- Greater visibility at offer and during onboarding.

Offer letters need to have the necessary details for candidates to fully understand the value of their stock options, beyond the number of options they are being offered. Onboarding should also include an overview on how stock options work and resources for further information. - Ongoing education sessions, especially ahead of funding rounds, new valuations, or an IPO.

Companies should provide education about how to calculate the value of stock options, how the exercise process works, the taxes associated with options, and how trigger events could impact their stock options. Companies should also consider bringing in third-party equity and tax experts to help explain these details. - Access to financial and tax professionals for individual equity planning.

Employees should have direct access to tax and financial professionals that can advise them on their own personal equity situation. Companies can't legally provide financial advice to employees but they can provide access to vetted third-party professionals. - Take financial risk off the table.

Offer access to sources of financing that have less personal risk for employees. This helps employees access the cash they need to pay for exercising costs. It will also help protect them in the event of a company failure or a less-than-ideal exit.

Methodology & demographics

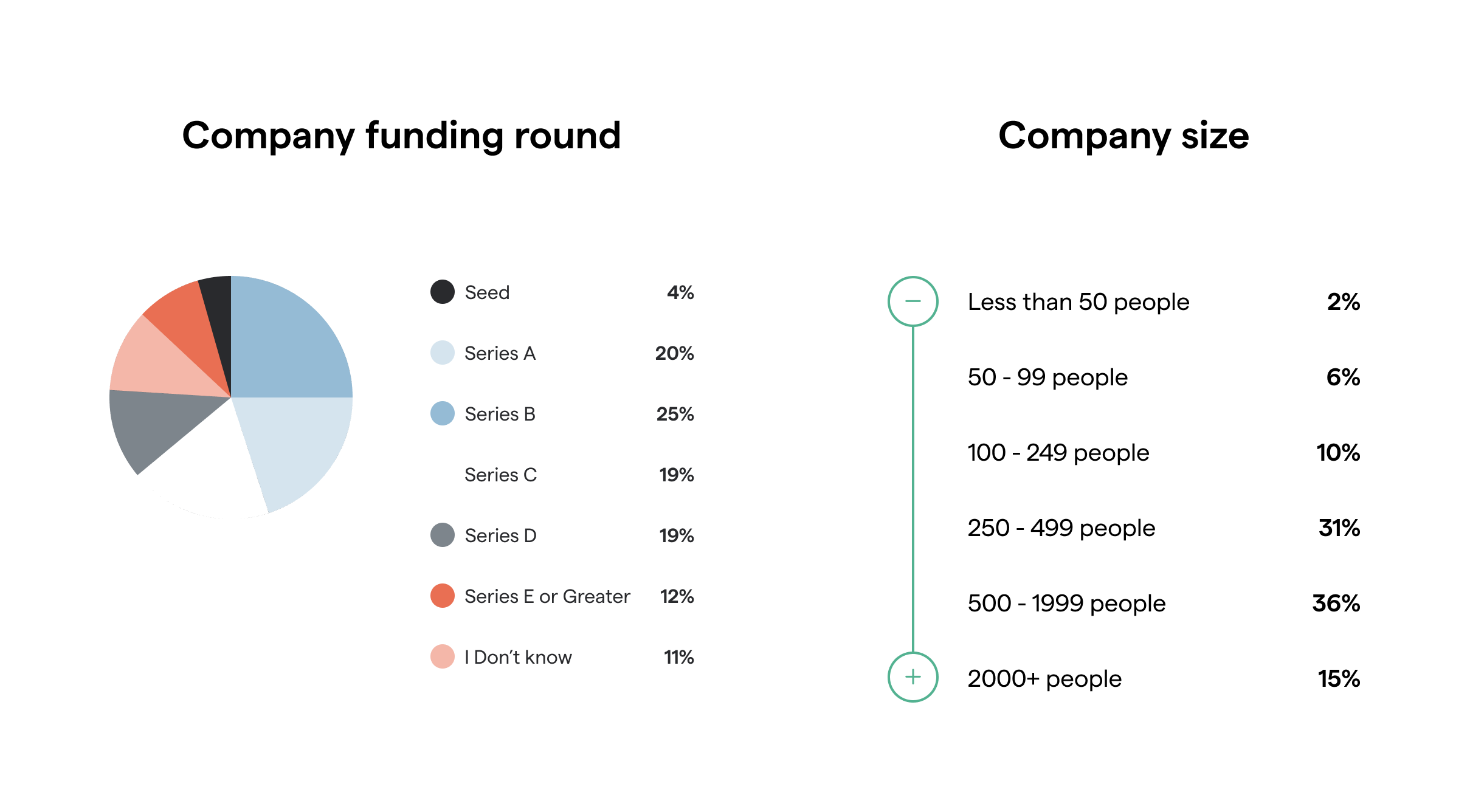

This national survey of over 1,000 startup employees was commissioned by Secfi and conducted by Propeller Insights, an independent survey research firm in 2021. Propeller Insights uses quantitative and qualitative methodologies to measure and analyze marketplace and consumer opinions.

Your partner for employee equity education and financing.

About Secfi

Secfi is trusted by thousands of startup employees for equity planning and financing. We’re the first to provide a proprietary suite of equity planning tools, 1:1 guidance with licensed equity strategists and a set of financing products that enable employees to own a stake in the company they helped build. We also provide company-wide education for startups at all stages to help their team make the best decision for their own situation. Currently, we have worked with employees from more than 80% of all U.S. unicorns. For more information, please visit www.secfi.com.